Leverage your holdings to:

✅ Unlock cash flow tax-efficiently

✅ Borrow at competitive rates (as low as 5.3%)

✅ Protect gains while staying invested

✅ Maximize your wealth without triggering capital gains.

Leverage your holdings to:

✅ Unlock cash flow tax-efficiently

✅ Borrow at competitive rates (as low as 5.3%)

✅ Protect gains while staying invested

✅ Maximize your wealth without triggering capital gains.

Best Fund Over 5 Years - Out of 120 Flexible Portfolio Funds*

5 years, 2012-2017

Best Fund Over 5 Years - Out of 123 Flexible Portfolio Funds*

5 years, 2013-2018

America's Top Performers - Best Fund Under $100M - Equity*

2021

Effectively managing your concentrated stock positions is crucial for minimizing risks and maximizing returns. We collaborate with you to develop customized strategies tailored to your specific challenges. Our key approaches include:

A concentrated stock position occurs when a significant portion of an individual’s wealth is tied up in a single stock or a limited number of stocks. Understanding the ins and outs of it is essential for investors who want to make informed decisions and effectively manage the associated risks and rewards.

Concentrated stock positions have benefits, risks, and strategies you can employ to manage and diversify. Additionally, we will describe the tax implications and strategies associated with these positions, ensuring you have a comprehensive understanding of how to navigate the complexities of concentrated stock investments.

Handling a concentrated stock position requires a comprehensive approach that includes evaluating the associated risks, developing a diversification strategy, trading options, and considering tax implications. Working with a financial professional, can help you create a personalized plan to effectively manage your concentrated stock position while aligning with your overall financial goals and risk tolerance.

At Lyon’s Wealth, our mission is to empower investors like you to harness the full potential of your concentrated stock position. With our expert guidance, personalized strategies, and commitment to your financial success, we’re ready to help you transform your investments into a more diversified, resilient, and tax-efficient portfolio.

We regularly assist clients in diversifying their concentrated stock position to mitigate risk and enhance the overall performance of stock shares in their portfolios. Here are four practical strategies for diversifying concentrated stock:

Managing the tax implications is crucial to optimizing investment outcomes and preserving wealth. It is essential to understand the tax consequences of selling, gifting, or donating shares, as well as the strategies available for minimizing tax liabilities while still effectively managing your investments. That’s why it’s so important to work with a financial advisor to develop a tax-efficient strategy for managing concentrated stock positions.

Lyons Wealth advisors will help you navigate the complexities of the tax landscape and make informed decisions that optimize your investment outcomes and preserve your wealth.

“Continuity should be one of the main factors when you look into investing with a financial advisor or wealth manager.”

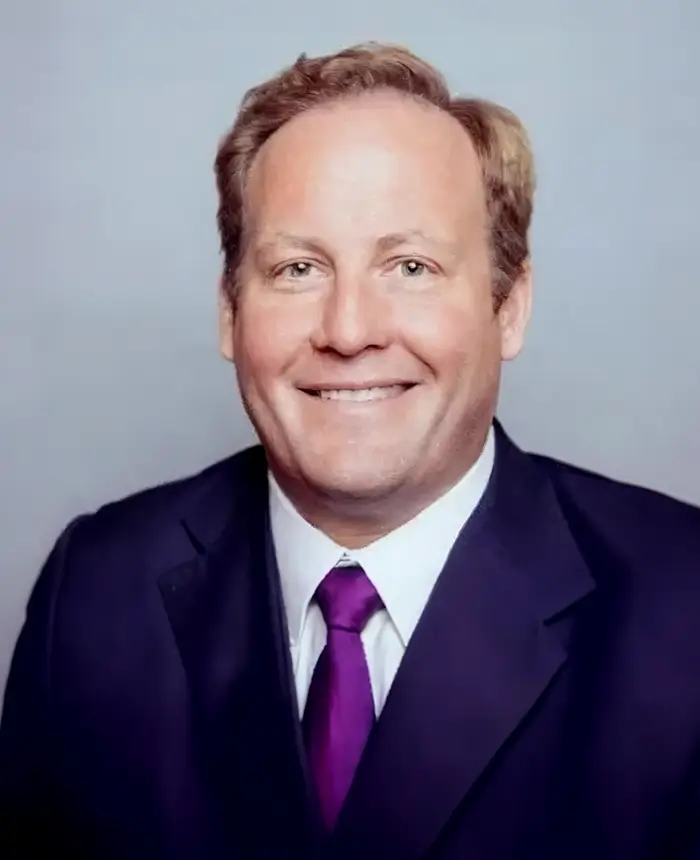

Sander Read

President & Chief Executive Officer

31 Years Managing Wealth

“The big hurdle is the lack of support for recovering passwords, keys, and digital asset locations, making pre-planning crucial.”

Corey Roun

Sr. Director of Trading & Derivatives Strategies

15 Years with Lyons Wealth

“We have a fiduciary duty to always put clients’ interests first, we only do better, when you do better.”

Matt Ferratusco

Senior Portfolio Manager & Analyst

9 Years with Lyons Wealth

At Lyons Wealth, we get to know our clients to understand their specific goals, objectives, needs, and future desires. We look for a good fit for everyone involved and want to engage in long-term relationships with the clients we advise. Our client roster ranges from:

“Working with Lyons has been amazing. The team is professional and communicative so I always know how my investments are doing.”

“Lyons Wealth Management helped educate me and allay my fears, as well as provided solid guidance on steps I could take to help me reach my goals even sooner.”

Schedule a call with a financial advisor to discuss how Lyons Wealth can help you manage your concentrated stock position!

Disclaimer:

Past performance is not a guarantee of future results.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Catalyst Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling 866-447-4228 or at www.CatalystMF.com. The prospectus should be read carefully before investing. The Catalyst Funds are distributed by Northern Lights Distributors, LLC, member FINRA/SIPC. Catalyst Capital Advisors, LLC is not affiliated with Northern Lights Distributors, LLC.

Risk Considerations:

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security in the Fund’s portfolio. The Fund is non-diversified and may invest a greater percentage of its assets in a particular issue and may own fewer securities than other mutual funds. The performance of the Fund may be subject to substantial short term changes. Interest rate risk is the risk that bond prices overall, including the prices of securities held by the Fund, will decline over short or even long periods of time due to rising interest rates. These factors may affect the value of your investment.

As of 12/31/2023, CLTAX received 2-stars for 3 years, 2-stars for 5 years, 4-stars for 10 years, and 3-stars Overall in the Tactical Allocation Category out of 234, 214, 140, and 140 funds, respectively. As of 12/31/2023, CLTCX received 2-stars for 3 years, 2-stars for 5 years, 3-stars for 10 years, and 3-stars Overall in the Tactical Allocation Category out of 234, 214, 140, and 140 funds, respectively. CLTIX received 2-stars for 3 years, 3-stars for 5 years, 4-stars for 10 years, and 3-stars Overall in the Tactical Allocation Category out of 234, 214, 140, and 140 funds, respectively.

The Morningstar RatingTM for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life sub-accounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10- year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

© 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

The Thomson Reuters Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. The Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the Lipper Fund Award. For more information, see www.lipperfundawards.com. Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. The Lipper award is for the A share class only.

Investors Choice Awards Methodology – All funds reporting to Allocator.com are considered for the awards. The Top Performer Awards – these are granted to the select few funds which have outperformed their wider peer group in each category. Winners are determined purely based on quantitative risk-adjusted returns. The 2021 Top Performer award winners will be chosen based on absolute returns from January 1, 2020 to December 31, 2020. The Long Term categories consider returns from January 2018 to December 2020.

© 2023 Morningstar. CLTIX rated 4 stars for the period ending 1/31/2024, based on 5-year risk adjusted returns out of 213 funds in the Tactical Allocation category, is rated 2 stars for the 3-year period ending 1/31/2024 in the Tactical Allocation category based on risk adjusted returns out of 231 funds, and the overall rating for is 3 stars for the period ending 1/31/2024 based on 5-year risk adjusted returns out of 231 funds in the Tactical Allocation category. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.